Business Environment: Economic Policies -The Commerce subject detailed notes with practice tests are very useful for Assistant Professor / UGC NET / JRF and other competitive exams preparation.

There are basically five economic policies:

1. Industrial Policy

2. Monetary Policy

3. Fiscal Policy

4. Foreign Investment Policy

5. Foreign Trade Policy (Export Import Policy or EXIM Policy)

Economic Policies

According to Assistant Professor / NTA-NET syllabus, we are focussing on monetary and fiscal policies. Many aspects of monetary policy have been discussed later, in Unit 7, Banking and Financial Institutions. The liquidity concept has been discussed in international monetary system.

Monetary Policy

Monetary Policy refers to the use of monetary instruments under the control of the central bank to influence variables, such as interest rates, money supply and availability of credit, with a view to achieving the policy objectives. The main objectives of the monetary policy are:

1. Price stability—low inflation to stabilize the economy from output and price shocks

2. Providing adequate credit to productive sectors and

3. Financial stability

Money Supply

The total stock of money in circulation among the public at a particular point of time is called money supply. The measures of money supply in India are classified into four categories M1, M2, M3 and M4 along with M0. This classification was introduced by Reserve Bank of India in 1977. These different ‘Ms’ are called ‘Monetary Aggregates’.

Let’s discuss them one by one:

1. Reserve Money (M0): It is also known as High-Powered Money, monetary base, base money, etc.

M0 = Currency in circulation + Bankers’ deposits with RBI + Other deposits with RBI

It is the monetary base of economy.

2. Narrow Money (M1):

M1 = Currency with public + Demand deposits with the banking system (current account, saving account) + Other deposits with RBI

3. M2 = M1 + Savings deposits of post office savings banks

4. Broad Money (M3):

M3 = M1 + Time deposits with the banking system

5. M4 = M3 + All deposits with post office savings banks

The liquidity of money supply means how fast an instrument can be converted into cash. In terms of liquidity: M1>M2>M3>M4,

(a) M1 is the most liquid and M4 is the least liquid.

(b) The broad money (M3) is an important indicator of monetary policy.

(c) M1 is known as the Narrow Money.

Now, with the opening up of financial markets, the use of these indicators has decreased.

Money Multiplier

Money Multiplier is the relationship between the monetary base and money supply in our economy – the amount of money that bank generates with each unit of money. It is the ratio of deposits to the reserves in the banking system.

Let’s assume that total deposit in banking system is 100 and reserve ratio requirement is 10%. The banks can lend 90% of deposit, i.e., 90. This 90% that banks will lend to its customers will ultimately be deposited in another bank which can further lend 90% of that, i.e., 81. This cycle continues this way, and a small increase or decrease in money supply has multiple impacts on the economy.

Money that is issued and guaranteed by government or some monetary authority, without legal constraint is counted as ‘Fiat Money’.

RBI or any central bank derives its objectives from their respective mandates. In the literature and in practice, price stability is considered as the dominant objective of monetary policy. For countries, which have adopted inflation targeting framework, price stability is the core objective.

Monetary policy changes can be done at any point of time during the year. Fiscal policy does not have such flexibility.

While money supply is required for growth stimulus in the economy, we need to have basic idea about the following.

1. Primary Credit Needs: For promotion of legitimate economic activities, these are basically routine activities.

2. Secondary Credit Needs: There is need of credit for meeting situations such as budgetary deficits, subsidies, loan waivers etc. Such expenditures are thus not only non-productive but are also unrelated to the growth process in the economy. For example, loan waivers are clearly negative expenditure.

The fulfilment of the objective of controlling secondary credit needs depends upon the two factors:

1. Instruments of monetary policy designed to regulate the flow of credit

2. An effective credit planning and implementation system

Monetary Policies

Let’s discuss the two types of monetary policies as some question can be expected from them.

1. Expansionary Monetary Policy: Central banks use monetary policy to manage the supply of money in a country’s economy. With monetary policy, a central bank increases or decreases the amount of currency and credit in circulation. This is a continuous effort to achieve the twin objectives of controlling inflation and ensuring growth of economy.

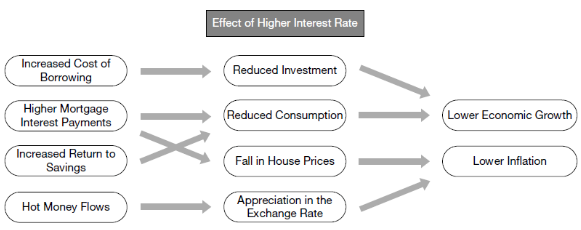

2. Contractionary Monetary Policy: Conversely, if a country’s economy is overheated (known as hot economy that shows very high growth rate) and there are signs of rising inflation, the central bank may enforce a contractionary monetary policy by increasing the rate. The rate hike discourages banks from excessive overnight lending activities. Thus, the banks will raise interest rates charged to their customers to compensate for the higher overnight rates. It leads to a decrease in money circulation in the economy, which prevents inflation.

Interest is the reward for lending and the cost of borrowing. The interest rate is the percentage rate charged on a loan or paid on savings. Customers with debts have less income to spend because they are paying more interest to lenders.

Credit aggregates are usually the asset side of a bank that depends upon the interest rates and monetary policy. The additional concept of ‘Inflation Expectation’ is also used when interest rates are decided by RBI.

RBI’s Policy Rates: This monetary policy responsibility is explicitly mandated under the Reserve Bank of India Act, 1934. The interest rates are the most dynamic aspect. The four policy rates that are announced by RBI at its bi-monthly Monetary Policy Meetings have been discussed below.

1. Repo Rate: The rate at which funds are provided by central bank to banks.

2. Reverse Repo Rate: The rate at which banks provide funds to central banks.

Liquidity Adjustment Facility (LAF): It consists of space between both repo rate and reverse repo rate.

3. Marginal Standing Facility (MSF): MSF is a window for banks to borrow from RBI in an emergency situation when inter-bank liquidity dries up completely. The MSF rate is pegged 100 basis points or a percentage point above the repo rate. Under MSF, banks can borrow funds up to one per cent of their net demand and time liabilities (NDTL). The minimum amount for which RBI receives application is ₹1 Crore. The amount was increased from 2 to 3% of the respective NDTLs of banks under the Covid19 situation.

4. Bank Rate: Bank rate is the interest at which the Central Bank of any nation provides a loan to its domestic banks. It started in 1900.

5. Standing Deposit Facility (SDF): In 2018, the amended Section 17 of the RBI Act empowered the RBI to introduce the SDF – an additional tool for absorbing liquidity without any collateral. There will be no binding collateral constraint on the RBI, the SDF strengthens the operating framework of monetary policy. The SDF is also a financial stability tool in addition to its role in liquidity management.

The SDF will replace the fixed rate reverse repo (FRRR) as the floor of the LAF corridor. Both MSF and the SDF will be available on all days of the week, throughout the year. The FRRR along with the SDF will impart flexibility to the RBI’s liquidity management framework.

The following concepts are also important:

1. Cash Reserve Ratio (CRR): The average daily balance that a bank is required to maintain with the Reserve Bank as a share of certain per cent of its NDTL that the Reserve Bank may notify from time to time in the Gazette of India.

2. Statutory Liquidity Ratio (SLR): The share of NDTL that a bank is required to maintain in safe and liquid assets, such as, unencumbered government securities, cash and gold. Changes in SLR often influence the availability of resources in the banking system.

3. Open Market Operations (OMOs): These include both, outright purchase and sale of government securities, for injection and absorption of durable liquidity, respectively. It has been discussed in the coming paragraphs.

4. Market Stabilization Scheme (MSS): This instrument for monetary management was introduced in 2004. Surplus liquidity of a more enduring nature arising from large capital inflows is absorbed through sale of short-dated government securities and treasury bills. The cash so mobilised is held in a separate government account with the Reserve Bank.

These have been discussed in detail in Unit 7 of Banking and Financial Institutions.

In India, policy rates are decided every two months, that is six times in a year. Each percentage point in rate of interest is equivalent to hundred basis points.

1% = 100 basis points

Monetary Policy Transmission: RBI takes care that monetary policy is implemented by banks in a fair manner. The policy rates (discussed on this page) should be implemented by the banks.

The four key channels of monetary policy transmission are:

1. Interest rates

2. Asset prices

3. Exchange rates

4. Credit aggregates

Fiscal Policy

This policy operates in varying economic conditions – cultural, legal and political environment. In India, the fiscal policies aim at the following objectives:

1. To promote and accelerate productive growth both in the public and the private sectors

2. To maximize real and financial resources through, taxes, savings and investment

3. To ensure economic stability

4. To redistribute the growing national output.

5. To provide the necessary incentives to the private sector for its healthy growth

Fiscal policy is the use of government spending and taxation to influence the economy. Governments typically use fiscal policy to promote strong and sustainable growth and reduce poverty.

Fiscal Policy has become more popular after the great depression of 1930s. According to Keynes, fiscal adjustments in any period are in the direction of stimulus or restraint and these adjustments take place through government purchase of goods and services, transfer payments and taxes.

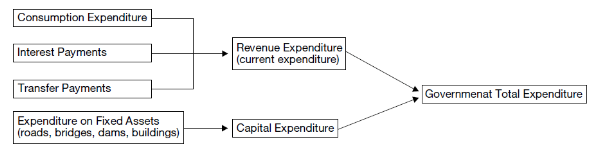

Revenue Expenditure is that part of government expenditure that does not result in the creation of assets.

• Main examples are payment of salaries, wages, pensions, subsidies and interest payments. The revenue expenses are incurred by the government for its operational needs.

• All grants given to state governments and Union territories are also treated as revenue expenditure, even if some of these grants may be used for the creation of capital assets.

• The central government pays subsidy under three major heads – food subsidy, fertiliser subsidy and fuel subsidy.

Capital Expenditures are for the creation of fixed assets, which are expected to be productive assets for a long period of time. The depreciation is charged on capital expenditure. The amount for purchase of fixed assets is also higher.

The tax revenues fall into two categories:

1. Direct Taxes: Direct tax is charged on income, salary or profits of an individual or corporates. In the case of direct tax, the burden can’t be shifted by the taxpayer to someone else. These are largely taxes on income or wealth. Income-tax, corporation tax, property tax, inheritance tax and gift tax are examples of direct tax.

(a) Long-term Capital Gain Tax is charged if income is generated from sale of an investment that is held longer than 12 months.

(b) Securities Transaction Tax (STT) is a levy charged at the time of purchase and sale of securities listed on stock exchanges in India. STT was introduced in the Union Budget of 2004.

(c) Commodities Transaction Tax (CTT) is a levy on exchange-traded commodity derivatives in India on the lines of the Securities Transaction Tax.

(d) Minimum Alternate Tax (MAT) is a levy which is applied to a corporate entity when its taxable income calculated as per the normal provisions in the IT Act falls below 18.5 per cent of book profits.

2. Indirect Tax: Indirect tax is a levy where the incidence and impact of taxation do not fall on the same entity. The burden of tax can be shifted by the taxpayer to someone else. Indirect tax has the effect to raising prices of products on which they are imposed. Customs duty, import duty, central excise, service tax and value added tax are examples of indirect tax. They have now been subsumed under Goods and Service Tax (GST).

The complete revenue structure has been put in the following diagram.

Thus, analysis of India’s fiscal policy is mostly done by three objectives:

1. To promote saving and capital formation

2. To reduce economic inequalities

3. To bring about domestic stability, specially to curb inflationary tendencies in the economy

Governments directly and indirectly influence the way resources are used in the economy. The basic equation of national income accounting helps show how this happens:

GDP = C + I + G + NX

On the left side is Gross Domestic Product (GDP)—the value of all final goods and services produced in the economy.

On the right side are the sources of aggregate spending or demand—private consumption (C), private investment (I), purchases of goods and services by the government (G), and exports minus imports (net exports, NX).

Besides providing goods and services, fiscal policy objectives vary across countries:

1. In short-term, governments focus on macroeconomic stabilization, for example, stimulating an ailing economy, combating rising inflation, or helping reduce external vulnerabilities.

2. In longer-term, the aim is to foster sustainable growth or reduce poverty with actions on the supply side to improve infrastructure or education.

The difference between Gross Domestic Product (GDP) and Gross Value Added (GVA)

Government has started making more use of GVA instead of GDP.

GDP calculates national income by adding up all expenditures in the economy. GDP is the value of all “final” goods and services— those that are bought by the final user. GVA calculates the national income from the supply side by looking at the value added in each sector of economy.

GDP = GVA + Taxes earned by the government – subsidies provided by the government

We can see from data that government earns more money than it spent on subsidies, GDP will be higher than the GVA. If subsidies are in excess of taxes, then GVA will be higher than GDP.

Fiscal Deficit

In the budgetary language,

The gross fiscal deficit (GFD) is the excess of total expenditure including loans net of recovery over revenue receipts (including external grants) and non-debt capital receipts. The net fiscal deficit is the gross fiscal deficit less net lending of the Central government.

Primary deficit is measured to know the amount of borrowing that the government can utilise, excluding the interest payments. A decrease in primary (or any) deficit shows progress towards fiscal health. The deficit is also mentioned as a percentage of GDP. It is needed to get a proper perspective and facilitate comparison.

Hence, when the primary deficit is zero, the fiscal deficit becomes equal to the interest payment. This means that the government has resorted to borrowings just to pay off the interest payments. Further, nothing is added to the existing loan.

Effective Revenue Deficit (ERD): This concept was introduced in budget 2011–12, under Rengarajan Committee recommendations. While revenue deficit is the difference between revenue receipts and revenue expenditure, the present accounting system includes all grants from the Union Government to the state governments/Union territories/other bodies as revenue expenditure, even if they are used to create assets. Such assets created by the sub-national governments/bodies are owned by them and not by the Union Government. Nevertheless, they do result in the creation of durable assets.

In short, Effective Revenue Deficit is the difference between revenue deficit and grants for creation of capital assets.

Impact of High Fiscal Deficit

We can have a look at the scenario when the fiscal deficit is too high.

1. Money Financed (or Monetized Deficit): Money is created by RBI. Most of the times during earlier period, the fiscal deficit was financed by RBI that will purchase government bonds or securities. Thus, Government will get money to finance its needs. This will increase the total supply of money in the market, and cause inflation. This is actually the borrowing by the Government of India.

The bonds created for such purpose may be sold in the market at a later stage, and RBI will suck out money from the market, and thus rein in increase in prices.

This type of situation may happen during Covid19 epidemics when government gets less revenue, but its expenses increase as a result of health and other benefits it extends to industry.

2. If the fiscal deficit is bond financed, it leads to high interest rates as government has massive requirements, and if money is withdrawn this way, it may lead to increase in interest rates.

3. If fiscal deficit is tax financed, it may lead to disincentive that is not good for investment in economy.

4. If fiscal deficit is financed externally (means M-X), then it may lead to debts. Rupee also gets depreciated against dollar and other currencies. Higher inflation in India in comparison to inflation in USA also results in more depreciation of rupee.

Fiscal Deficit, Saving and Capital Formation

If rate of taxation is high, then consumers will have less money to spend and saving rate will also be less. Thus, capital formation will also go down. The future GDP growth rate will also go down. The less capital formation may tempt government to invite foreign investment.

Fiscal Policy and Debt Formation

1. The fiscal and other deficits lead to accumulation of debt, there will be more borrowing as a result and more interest burden. There will be less money. The private sector will be ‘crowded out’ as they won’t be able to make their ventures profitable. The economic growth rate will also suffer. There will be less jobs and employment.

2. In heavy deficit conditions, the central bank may print more currency that is called as automatic printing of currency. Government went for ‘adhoc bills’ till 1996–97 to face such situations. The more printing may lead to inflation, though we made adequate laws and arrangements to avoid such situations.

3. If taxes are raised for debt repayment, then disincentives to work, save and invest may result out of such decisions.

4. If foreign institutions or investors such as IMF finance the debt, then problems may aggravate. IMF is actually meant for short-term financing.

The proportion of debt to GDP matters a lot. If debt-GDP ratio rises, then debt problem may face the following situations:

1. Primary Deficit

2. Interest Rates

3. Economic Growth Rate

India usually have debt equity ratio of 67–70 per cent, but post COVID19, it may increase to 90 per cent in 2022.

Japan suffers from 3D impact—Debt, Deflation and Demographics since 1990s. Japan has public debt to GDP ratio is 500% but the financing is mostly internal.

In case of USA, public debt to GDP ratio is 105 % but its reserve currency status may not cause any issue.

In the case of incidence of indirect taxes, Jha committee showed that these are mostly proportional to the levels of consumer expenditure. The increase in productivity usually fails to absorb the rise in costs due to taxation and other related factors. The high cost is further burdened by high prices, scarcities, harsh living conditions and lack of employment opportunities. Thus, tax system and changes in it increases the social discontent and the sense of grievance against public authority.

Fiscal Policy and Inflation

The public expenditure fuels inflationary forces in the country. Public expenditure adds to the demand-pull inflation. Investment in human capital will help achieve inclusive growth, and furthermore such expenditures should be considered as part of capital expenditure rather than as revenue expenditure.

Public expenditure is spending made by the government of a nation on collective needs and wants, such as social security, different provisions (education, healthcare and housing etc.), providing security, building up infrastructure, etc.

Adolph Wagner in the year 1883, gave a law called the ‘law of ever increasing state activity’ on the basis of his study in Germany and some other nations. The law states that there is a persistent scope for the government to expand its activities due to these three factors – higher economic development, higher administrative and protective actions and better welfare functions.

In the 20th century, John Maynard Keynes argued the role of public expenditure in determining levels of income and distribution in the economy. Since then, government expenditures has shown an increasing trend. Sources of government revenue include taxes, and non-tax revenues.

We can talk about some recent developments. Our public expenditure and fiscal deficit have shown an increase risen during recent times due to Covid19. (Earlier higher fiscal deficits happened due to stimulus packages offered after US recession in 2008-09). The current central fiscal deficits were 9.2% in 2019-20, 6.9% in 2020-21 and a projected 6.4% in 2021-22. If we combine state level deficits with central level deficits, they will exceed 10% of GDP. Any level exceeding 10% of GDP is deemed as a ‘crisis level’ situation by International Monetary Fund (IMF).

Banks print trillions of dollars to keep interest rates down in such situations. But inflation kept low due to better production efficiencies. Globally, there was low consumption due to ageing population in the world. This causes to savings glut. In such a situation, target of 3% set by Fiscal Responsibility and Budget Management (FRBM) in India seems to be very moderate. Now our debt is more than 90% of GDP. A higher fiscal deficit may lead to ‘balance of payment’ crisis and a higher ‘current account deficit’. But as in the beginning of 2022, our Foreign Exchange Reserves are more than $ 633 billion due to high FDI, FPI and comfortable exports.

Inflation perspective seems to have changed during recent times. Some economists, such as Government’s Principal Economic Advisor Sanjeev Sanyal says that high fiscal deficit does not cause inflation. To him, inflation happens due to ‘high monetary growth’. So we can see that a combination of factors contribute to the overall situation. As on February 10, 2022, our repo rate and reverse repo rate are 4% and 3.35% respectively. We will have fair idea of all these aspects in coming chapters as well.

Purchasing Power Parity (PPP) and Law of One Price (LOOP): PPP is used worldwide to compare the income levels in different countries. PPP thus makes it easy to understand and interpret the data of each country. Suppose, a cup of coffee costs ₹25 in India and One dollar in USA. Thus, One dollar = ₹25 on the basis of PPP. But in market, one dollar = ₹75. Thus, PPP indicates a ratio of 3 for India that is calculated by ₹75 / ₹25. It means that Indian rupee purchasing power is three times in practical terms. The Law Of One Price (LOOP) is also closely linked with it.

According to World Bank’s International Comparison Program (ICP) in June 2020, China, USA, India and Japan are the four biggest Purchasing Power Parity based economies.

Important Developments in Fiscal Scenario

India has adopted mixed economy since 1950–51.

1. Government could achieve higher growth rates in 1950s and 60s by making more public investments. Higher taxation was used for reducing private consumption.

2. During 1970s, government spent money on social justice, social equity and subsidies. The income tax rates were raised to 97%. With gift tax, the effective tax rate crossed 100%.

3. The fiscal deficits of both the Central and the State Governments were not excessive up to 1980. There was a significant It degraded at a fast rate in 1980s. Government tried to control the situation by large and automatic ‘monetization’ of such deficits. But that lead to excessive inflation. There was increase in taxes to reduce fiscal deficit. There were structural changes in budget during 1980s.

4. The tax reforms initiated since 1991 were part of the ‘structural reforms process’. Tax Reforms Committee, headed by Raja Chelliah, recommended two major reforms on direct taxes—one was the simplification and rationalisation of the direct tax structure, the other was to introduce a service tax to widen the tax base. The 1992 reforms radically altered the composition of tax revenue at the central level.

5. Earlier, government used to get money almost free of cost through ‘Statutory Liquidity Ratio’, this process almost ended in 1997.

6. Fiscal Responsibility and Budget Management (FRBM) Act was enacted in 2003 with following objectives.

(a) to reduce fiscal deficit (3%),

(b) ensure inter-generational equity in fiscal management,

(c) long-run macroeconomic stability,

(d) better coordination between fiscal and monetary policy, and

(d) transparency in the fiscal operations of the government.

RBI was given more flexibility in norms to manage inflation in India (mostly by curbing flexibility in printing of currency to meet fiscal deficit of government). However, due to the global financial crisis of 2008, the deadline for the implementation of the targets in the Act was suspended. FRBM Act was revised in the years 2012 and 2015.

7. Corporation tax now is the major source of direct tax.

8. The indirect tax structure could see significant changes. Both domestic excise duties that were levied on manufactured goods and customs duties on imports have undergone considerable simplification and rationalisation. Besides reduction in the number of rates, the tax has been progressively reduced.

These were further merged into a single rate in 2000–01 to be called a Central Value Added tax (CenVAT), subsequently its rate was further reduced. The rationalistaion of Custom duties also started in 1991–92.

Value Added tax (VAT) was introduced in India from 1 April 2005. The existing general sales tax laws were replaced with the Value Added Tax Act (2005) and associated VAT rules.

9. General Anti-Avoidance Rule (GAAR) has been a tool in the taxman’s hands to go after foreign investors – particularly offshore fund managers – escaping tax by setting up letterbox companies in tax havens. They were first proposed in 2009, and implemented in 2017 after many delays.

10. On July 1, 2017, Goods and Services Tax (GST) was introduced in India after prolonged discussions and legislative process. The rate of inflation has come down. Thus, we can see how fiscal and monetary objectives are interlinked. The five year cushion for states to cover potential losses ended on July 1, 2022.

11. Multiplicity of goals in fiscal policy requires a disaggregated approach. There are always some conflicts between allocation and stabilization goals. The effects of fiscal policy are specifically measurable in employment, price stability, savings and investment, and the balance of payment.

Agenda for future reforms involve the following themes:

1. Reduction and redirection of subsidies

2. Implementing a new approach to administered prices

3. Better coordination and cooperation between fiscal and monetary policies—price stability and growth.

4. Fiscal sustainability—Debt GDP ratio, interest rates

5. Further reductions in budgetary allocations to public sector undertakings

6. Measures to tighten expenditure control, and

7. Completion of the tax reform agenda

Crowding Out Effect

This refers to a phenomenon where increased borrowing by the government to meet its spending needs causes a decrease in the quantity of funds that is available to meet the investment needs of the private sector. The increased rate of interest will increase the cost of funds. Thus, it may adversely affect the economic growth. Some believe that government spending does not always lead to a crowding out of private investment in the economy. They instead argue that government demand for funds can compensate for the lack of private demand for funds during economic depressions, thus helping to prop up aggregate demand.

This crowding out effect was anticipated in budget 2022, when government relied upon higher borrowing to revive and boost the growth of economy.

Laffer Curve

The Laffer Curve describes the relationship between tax rates and total tax revenue, with an optimal tax rate that maximizes total government tax revenue. In this case, cutting tax rates will both stimulate economic incentives and increase tax revenue.

Comparison Between Monetary and Fiscal Policy

| Tool | Interest rates | Tax and government spending |

| Effect | Cost of borrowing/mortgages | Budget deficit |

| Distribution | Higher interest rates hit homeowners but benefits savers | Depends which taxes you raise |

| Exchange Rate | Higher interest rates cause appreciation | No effect on exchange rate |

| Supply Side | Limited impact | Higher taxes may affect incentives of work |

| Politics | Monetary policy set by independent Central Bank | Changing tax and government spending highly political |

| Liquidity trap | Cuts in interest rates may not work in liquidity trap | Fiscal policy advised in very deep recessions |

Export–Import Policy (EXIM Policy)

The main objective of Export Import Policy is improve export performance in globalized environment. The main focus of Foreign trade policies during 1950s and 1960s was self-reliance and self-sufficiency of the country. In 1962, the Government of India appointed a special EXIM Committee to review the previous export import policies of the Government. The policies during (and post) 1970s were driven by the objectives of export led growth and increased efficiency and competitiveness.

EXIM Policy was adopted on the 12th of April, 1985. Initially, the EXIM Policy was introduced for the period of three years with main objective to boost the export business in India. The year 1991 is usually considered as the ‘watershed year’, with many economic reversals. Many economic reforms were adopted thereafter.

Foreign Investment Policy

Foreign Investment is required so as to cover the gap between desired growth rate and the growth rate that can be achieved with domestic savings and capital. Suppose we want to achieve 9% growth rate. For that our saving rate (domestic capital formation) should be 38% of GDP. But actually, it is 30%. To cover the gap, we need foreign investment. A foreign investment policy is to be designed in such a manner so that we can compete with other countries to attract foreign investment. They have been discussed under Foreign Direct Investment (FDI) and Foreign Portfolio Investment (FPI).

Business Environment: Economic System

Business Environment: Economic Environment

Main Concepts and Types of Business Environment

Business Environment and International Business : The Basics of Business Environment